Vestas Wind Systems A/S

| |

Global headquarters in Aarhus, Denmark | |

| Type | Public (Aktieselskab) |

|---|---|

| Template:OMX | |

| Industry | Electrical equipment |

| Founded | 1945 |

| Founder | Peder Hansen |

| Headquarters | , |

Key people |

|

| Products | Wind turbines |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 29,427 (end 2021)[1] |

| Website |

|

Vestas Wind Systems A/S designs, manufactures, installs, and services wind turbines worldwide. The company operates in two, Power Solutions and Service. The Power Solutions segment sells wind power plants, wind turbines, development sites, etc. The Service segment engages in the sale of service contracts, spare parts, and related activities. The company was founded in 1898 and is headquartered in Aarhus, Denmark.

Business Description edit edit source

Vestas is a pioneering force in transforming the global energy system towards sustainability. With a vision to become the Global Leader in Sustainable Energy Solutions, they are committed to making wind energy central to energy systems worldwide. Collaborating closely with key stakeholders across the energy landscape, Vestas aims to accelerate renewable expansion and ensure long-term energy security for future generations. Through their four business areas – Development, Onshore wind, Offshore wind, and Service – Vestas leads the way in installing renewable energy in numerous countries. With over four decades of experience, they have already avoided the emission of more than 1.9 billion tonnes of carbon dioxide. Their dedicated team of 28,000 employees works relentlessly to establish a strong value chain for wind energy, utilising industry-leading expertise in design, project development, manufacturing, installation, and operations. Embracing digitalisation, Vestas also focuses on strengthening the stability and predictability of renewable power generation.

While wind energy remains at the core of their business, Vestas acknowledges the importance of capabilities beyond power generation in creating a truly sustainable energy system. They are committed to exploring and deploying new innovations, encompassing improved sustainability performance and advancements in power storage, system flexibility, and electrification. With these efforts, Vestas aims to lead the global energy sector into a new era and accelerate progress towards net-zero emissions. Proudly offering a solution to the climate crisis and energy security, Vestas stands as a global leader in sustainable energy solutions. With their industry-leading expertise, they are dedicated to strengthening energy systems and driving the world towards a more sustainable future.

Business model edit edit source

Development – maximising wind resources by development of new wind energy

Onshore and Offshore Power Solutions – Powering the renewable energy transition through innovation and scalable solutions

Service – Maximising sustainable energy generation

company missions edit edit source

- Leading sustainability standards

- Technology leadership

- Unparalleled global scale

Management edit edit source

| Name | Profile |

|---|---|

| Henrik Andersen | a Danish national, serves as the Group President & CEO of Vestas Wind Systems A/S (DK). He was born on December 31, 1967, and resides in Denmark.

Henrik's educational background includes a Master's degree in Law from the University of Aarhus (DK) earned between 1993 and 1997. He also holds a Graduate Diploma in International Business from Aarhus School of Business (DK) obtained from 1988 to 1992. Throughout his career, Henrik has held various significant positions. From 2016 to 2019, he served as the Group President & CEO of Hempel A/S (DK). Prior to that, he held the position of Group Chief Operating Officer, EMEA, and Group Chief Financial Officer at ISS A/S (DK) from 2013 to 2015 and 2011 to 2013, respectively. He also served as the Country Manager at ISS A/S (UK) from 2009 to 2011 and held various management positions within the ISS Group from 2000 to 2009. Earlier in his career, Henrik held the position of Director Corporate Clients at Jyske Markets, Jyske Bank A/S (DK) from 1995 to 2000, and he served in various roles at Jyske Bank A/S and Sparekassen SDS (DK) from 1986 to 1995. Henrik also holds fiduciary positions, including being the Chairman of the board of Vestas Offshore Wind A/S (DK) and a member of the board at Saxo Bank (DK). Moreover, he serves as the Chairman of the audit committee of H. Lundbeck A/S* (DK) and a member of the investment committee of Maj Invest Equity 4 & 5 K/S (DK). (*H. Lundbeck A/S is a company listed on a stock exchange.) Henrik's expertise and leadership play a pivotal role in steering Vestas towards continued success as a leading player in the wind energy industry. |

| Hans Martin Smith | is a Danish national, born in 1979 and currently residing in Denmark. He holds the position of Executive Vice President & CFO at Vestas Wind Systems A/S.

Hans Martin's educational background includes a Master of Science in Business Management from the University of Aarhus, which he obtained in 2004. Prior to that, he completed his Bachelor of Science in Economics and Business Management from the same university in 2001. Throughout his career, Hans Martin has held various significant positions within Vestas Wind Systems A/S. He served as Senior Vice President and regional CFO for Vestas Northern & Central Europe from 2017 to 2022. Earlier, he held the position of Senior Vice President in Group Treasury and Investor Relations in 2016-2017, and Senior Vice President in Investor Relations and M&A from 2014 to 2016. Additionally, he served as Senior Vice President in Corporate Secretariat & Strategy in 2012-2014 and as Director in Corporate Secretariat in 2011-2012. His journey at Vestas began with various positions from 2004 to 2008. Prior to joining Vestas, Hans Martin worked as a Management Consultant at Rambøll Management from 2000 to 2004. Hans Martin also holds fiduciary positions and serves as a Member of the Board of Aktieselskabet Schouw & Co* (DK). Furthermore, he is the Chairman of the Audit Committee of Aktieselskabet Schouw & Co* (DK). (*Aktieselskabet Schouw & Co is a company listed on a stock exchange.) With his expertise and leadership as the CFO of Vestas Wind Systems A/S, Hans Martin plays a crucial role in the financial management and strategic direction of the company, contributing to its success as a global leader in the wind energy industry. |

| Christian Venderby | a Danish executive, born on August 1, 1969, and currently residing in Denmark. He holds the position of Executive Vice President & Chief Sales Officer (CSO) for Service at Vestas Wind Systems A/S.

Christian has been a significant part of Vestas Wind Systems A/S, serving as a member of the Executive Management since August 2019. Prior to his current role as Executive Vice President & CSO for Service, he held the position of Group Senior Vice President, Service, from 2014 to 2019. He also served as Chief Operating Officer at Vestas-American Wind Technology, Inc., in the USA from 2010 to 2014 and as Chief Financial Officer in the same organization from 2006 to 2010. Before joining Vestas, Christian held various key positions at FLS Industries A/S. These roles included Chief Financial Officer at FLSmidth India, Head of Turnkey Projects Administration at FLSmidth Egypt, Head of Finance at FLSmidth Brazil, and Head of Finance at FLSmidth Japan. With his diverse experience and expertise in finance and operations within the wind energy industry, Christian plays a vital role in Vestas' Executive Management, contributing to the company's continued growth and success as a leading global player in sustainable wind solutions. |

| Kerstin Knapp | An Austrian executive, born on December 19, 1975, and currently residing in Denmark. She holds the position of Executive Vice President & Chief Human Resources Officer (CHRO) at Vestas Wind Systems A/S.

Kerstin's educational background includes earning a Master's degree in Psychology from Karl-Franzens-University Graz, Austria, from 1994 to 2000. She further enhanced her expertise by completing a Global Executive MBA with a double degree from the University of Minnesota, US, and WU (Vienna University of Economics and Business) from 2016 to 2017. She also obtained certifications for Supervisory Board assignments in Austria and Germany. In her role at Vestas Wind Systems A/S, Kerstin became a member of the Executive Management on January 1, 2020. As Executive Vice President & CHRO, she is responsible for driving the company's human resources strategy and fostering a strong organizational culture. Before joining Vestas, Kerstin held several key positions at various prominent organizations. From 2016 to 2020, she served as Chief Human Resources Officer at Puma Energy in Switzerland. Prior to that, she held the position of Global HR Director at Compagnie Financiere Richemont SA from 2014 to 2016. Additionally, she worked at Cargill Inc., serving as Senior Vice President HR for CASC Global from 2012 to 2014 and as Vice President for CASC EMEA in 2011-2012. Kerstin also contributed her HR expertise at OMV AG, where she was Head of HR for Downstream from 2008 to 2010 and Head of HR for Petrom Downstream in Romania from 2006 to 2008. She began her career as Head of HR at Niedermeyer GmbH in Austria from 2002 to 2005. With her diverse international experience and strong background in human resources, Kerstin plays a critical role in Vestas' Executive Management team, ensuring the company's talent management and HR strategies align with its mission and objectives in the dynamic wind energy industry. |

| Tommy Rahbek Nielsen | A Danish executive, born in 1970 and currently residing in Denmark. He holds the position of Executive Vice President & Chief Operating Officer at Vestas Wind Systems A/S since 2020.

Tommy's educational background includes obtaining a Diploma in Finance and Business Administration from Aarhus University in 1999-2003. He further honed his leadership skills through an Executive Development and Leadership program at IMD in 2008-2009. With a strong foundation in finance and business administration, Tommy has held various key positions within Vestas Wind Systems A/S throughout his career. From 1994 to 1996, he worked as Finance Manager at HS Kedler - Tarm A/S. He continued to grow within Vestas, serving as Finance Manager from 1997 to 2003. In 2004-2006, he assumed the role of Chief Financial Officer at Vestas Central Europe (DE). Over the years, Tommy has played critical roles in Vestas' global operations and supply chain management. He served as Vice President of Global Capacity Planning from 2006 to 2007. From 2008 to 2009, he took on the responsibility of Vice President and Managing Director of Vestas Wind Systems China Ltd. Tommy's journey within Vestas continued, and he held the position of Senior Vice President of Group Forecasting & Planning from 2009 to 2011. From 2012 to 2015, he served as Group Senior Vice President of Supply Chain Planning. His expertise in assembly, generators, and towers led to his appointment as Senior Vice President of Assembly, Generators & Towers from 2016 to 2019. In 2020, Tommy Rahbek Nielsen assumed his current role as Executive Vice President & Chief Operating Officer, further solidifying his position as a key leader within Vestas Wind Systems A/S. With his extensive experience in operations, finance, and planning, Tommy plays a vital role in driving the company's operational efficiency and growth in the renewable energy sector. |

| Javier Rodríguez Diez | A Spanish executive, born on 29 June 1974 and currently residing in Denmark. He holds the position of Executive Vice President & CSO at Vestas Wind Systems A/S since July 2021.

Javier's educational background includes a degree in Industrial Engineering with Electromechanical Specialty from University E.T.S. Carlos III Madrid, which he completed in 1999. He further enhanced his leadership skills and knowledge through various executive development programs, including an Executive MBA from IE Business School in Madrid, Spain, in 2007. Throughout his career, Javier has played key roles in Vestas Wind Systems A/S, showcasing his expertise in sales and strategic leadership. He has been an integral part of Vestas' Mediterranean division, having served as the President of Vestas Mediterranean A/S from 2020 to 2021. His contributions were significant as the Senior Vice President of Global Sales at Vestas Wind Systems A/S from 2019 to 2020. Javier's journey with Vestas dates back to his early positions in Spain. From 1999 to 2001, he worked as a Development Manager at Sistemas e Instalaciones de Energías Renovables. He continued to grow within Vestas, taking on roles such as Sales Director at Neg Micon Spain from 2001 to 2004 and Sales & Marketing Director at Vestas Spain from 2004 to 2006. His leadership capabilities led him to become the General Manager of Vestas Spain from 2006 to 2008. He then served as the Senior Vice President of Sales and Key Accounts at Vestas Mediterranean A/S from 2008 to 2019, where he played a crucial role in driving sales growth and developing key customer relationships. Javier Rodríguez Diez's extensive experience in sales and his strategic contributions have earned him a place in the Executive Management team at Vestas Wind Systems A/S. As Executive Vice President & CSO, he continues to be instrumental in driving the company's sales and strategic initiatives in the global wind energy market. |

| Anders Nielsen | A Swedish national born on 18 December 1962 and currently residing in Sweden, is the Executive Vice President & CTO of Vestas Power Solutions. He assumed this role at Vestas Wind Systems A/S in May 2020 and has been a valued member of the Executive Management team since then.

Anders holds a Bachelor of Science degree in Industrial Engineering from the University of Linköping, which he earned in 1987. With an impressive career spanning several renowned companies, Anders has accumulated vast experience in leadership and engineering roles. Prior to joining Vestas, he served as the CTO of Traton Group from April 2016 to April 2019. From September 2012 to April 2015, Anders held the position of CEO at MAN Truck & Bus AG, where he played a crucial role in leading the organization. Before his time at Traton Group and MAN Truck & Bus AG, Anders spent an impressive 24 years with Scania Group. During his tenure, he held various leadership positions in Sweden and Latin America, showcasing his expertise and commitment to driving growth and innovation. Some of his notable roles within Scania include CTO of Scania LatAm, SVP of Chassis & Cab Production, and EVP of Production & Logistics. Anders Nielsen's extensive experience in engineering and leadership makes him an invaluable asset to Vestas Power Solutions. As the Executive Vice President & CTO, he continues to drive innovation and technological advancements within the company's power solutions division, contributing to Vestas' position as a leading player in the wind energy industry. |

| Mr. Thomas Alsbjerg | A Danish national born in 1973, currently holds the position of Executive Vice President for Vestas Digital Solutions and Vestas Development, a role he assumed in 2022.

Thomas has an impressive educational background, earning a Master of Science in Engineering from the Technical University of Denmark in 1998. Subsequently, he pursued a Bachelor of Science in finance at Copenhagen Business School, completing his studies in 2002. With a diverse career, Thomas has held several notable positions in various industries. From 2010 to 2019, he served in various leadership roles across operations, commercial, and support functions at Coloplast, a Danish medical device company. Prior to that, he gained extensive experience as a management consultant, working at renowned firms like A.T. Kearney and Accenture, where he contributed his expertise in both Denmark and the United States. Thomas joined Vestas in 2019, where he held several significant positions, including Group Senior Vice President and Head of Corporate Strategy, M&A, and Global Intelligence. In 2021, he assumed the role of Group Senior Vice President and Head of Vestas Development, showcasing his diverse skill set and expertise. Apart from his responsibilities at Vestas, Thomas also serves as a member of the board of Clinical Microbiomics A/S and Green Mobility A/S, contributing his knowledge and insights to these organizations. As the Executive Vice President for Vestas Digital Solutions and Vestas Development, Thomas Alsbjerg plays a key role in driving the company's digital transformation and development strategies. With his strong educational background and vast experience in various leadership roles, Thomas continues to make valuable contributions to Vestas, a leading player in the wind energy industry. |

Board Members edit edit source

| Name | Profile |

|---|---|

| Anders Runevad | A Swedish business leader and professional board member with extensive experience in the renewable energy industry. He currently serves as Chairman of the Board and a Member of the Board for Vestas Wind Systems A/S. With a background in electrical engineering and an MBA, he brings in-depth knowledge of international business, strategy development, and corporate management. Throughout his career, Anders has held prominent positions, including Group President & CEO of Vestas Wind Systems A/S from 2013 to 2019. His expertise and vision continue to drive success and growth in the renewable energy sector. |

| Karl-Henrik Sundström | Karl-Henrik Sundström - Biography Profile

|

| Eva Merete Søfelde Berneke | A Danish national born in 1969 and currently residing in France. With a remarkable career spanning various industries, Eva has emerged as a highly accomplished executive with expertise in corporate management, strategy execution, and digitalization. She currently holds the position of Chief Executive Officer at Eutelsat SA, a leading satellite communications company. Since 2019, Eva has also been an integral member of the board at Vestas Wind Systems A/S, a prominent player in the renewable energy sector. Her educational background includes an MBA from INSEAD and a Master of Mechanical Engineering from the Technical University of Denmark. Eva's visionary leadership, international experience, and profound understanding of risk management and human capital make her a valuable asset to the organizations she serves. |

| Helle Thorning-Schmidt | A Danish national born in 1966 and currently residing in the United Kingdom, is a distinguished professional board member with a wealth of experience and expertise. Since 2019, she has been an esteemed member of the board at Vestas Wind Systems A/S, a leading player in the renewable energy industry. Helle's outstanding competencies include an in-depth understanding of governmental affairs, strategic management of international organizations, and social and diversity matters. With a strong commitment to various fiduciary positions and positions of trust, she serves on the boards of prestigious organizations such as Carsøe Group A/S, DJE Holdings Limited, SafeLane Global Limited, and Vista Equity Partners. Helle also plays a significant role in important international initiatives, including the Danish Football Union (DBU)’s Governance and Development Committee and The Oversight Board. Her impressive educational background includes a Master's Degree in European Studies from the College of Europe in Bruges and a Master's Degree in Political Science from the University of Copenhagen. Helle Thorning-Schmidt's exceptional leadership and contributions make her a valued asset in shaping a sustainable future in the renewable energy sector and beyond. |

| Lena Olving | A Swedish national, is a seasoned professional known for her outstanding contributions to the tech sector. As the Founder & Partner of Olving & Ohberg AB, she has a wealth of experience in managing international high-tech companies. Lena's expertise spans various crucial aspects, including strategy, sales, services, restructuring, product development, and supply chain management. Her in-depth knowledge in environmental, social, and governance (ESG) matters, along with human capital management, makes her an invaluable asset for Vestas Wind Systems A/S.

Joining Vestas' board in 2022, Lena has been an active member of the Technology & Manufacturing Committee, assuming the role of Chair in 2023. She holds independent status from the company, management, and major shareholders, aligning with Danish Corporate Governance Recommendations. In addition to her role with Vestas, Lena serves in leadership capacities as Chair of the board of ScandiNova AB and holds board positions in Assa Abloy AB, Investment AB Latour, NXP Semiconductor NV, and Stena Metall AB. Her commitment extends to cultural and artistic domains, where she chairs The Royal Swedish Opera.

Lena Olving's academic background includes a Master's in Mechanical Engineering from Chalmers University of Technology. Her remarkable journey includes serving as CEO and President of Mycronic AB, Executive Vice President & COO of Saab AB, and Senior Vice President roles at Volvo Car Corporation (VCC). She has also been recognized for her management roles at Volvo Car Components Corporation (VCCC) and Volvo Car Area Asia Pacific (VCAP). |

| Kentaro Hosomi | A Japanese national, brings invaluable expertise to Vestas Wind Systems A/S as a Member of the Board since 2021. Re-elected in 2023, he serves as an independent member, aligning with the Danish Corporate Governance Recommendations. Kentaro's deep knowledge of power systems and energy industries makes him a valuable asset to Vestas. He has extensive experience in business development and sales of power systems, including thermal, nuclear, and renewable energy. Furthermore, he possesses valuable insights into leading strategic planning and implementing energy transition in fossil energy-related heavy industries.

With a Bachelor's degree in economics from the University of Tokyo, Kentaro has held various significant positions within Mitsubishi Heavy Industries, Ltd. Throughout his career, he has served as Executive Vice President and Chief Regional Officer for Europe, Middle East & Africa, and Executive Vice President & COO of Energy Systems. Kentaro Hosomi's expertise and vast experience make him a key contributor to Vestas' vision of sustainable energy solutions and energy transition. |

| Claus Skov Christensen | A Danish national, is a valued member of Vestas Wind Systems A/S Board of Directors since 2022. His term of office is set to expire in 2024, and he was elected by Group employees. With a background as a Lead Technician and Shop Steward for Danish Service Technicians, Claus brings a wealth of expertise to the table.

His journey began as an industry technician trainee at Rubens Maskinfabrik A/S, followed by roles as a Service Technician at N.E.G. Micon A/S and a construction worker stationed in various locations, including Berlin and Gibraltar. Additionally, he served in the Royal Danish Navy. Claus's in-depth knowledge of service processes and human resources within the Vestas Group make him an essential asset to the Board. As a dedicated and experienced professional, he actively contributes to Vestas' mission to provide sustainable energy solutions and drive the wind energy industry forward. |

| Michael Abildgaard Lisbjerg | A Danish national, is a skilled worker in production and shop steward at Vestas Manufacturing A/S. He has been a dedicated member of Vestas Wind Systems A/S Board since 2008, elected by Group employees. In 2020, he was most recently re-elected for a four-year term.

Due to his employment in Vestas Manufacturing A/S, Michael is not considered independent under the Danish Corporate Governance Recommendations. He holds fiduciary positions as the deputy chair of the boards of DM Skjern-Ringkøbing P/S and DMSR af 24. oktober 2016 ApS. Michael's commitment to continuous learning is evident through his various education courses, including Quality Optimization with Six Sigma, Economy, Logistics, Project Management, and more. With a diverse background, including service in the Royal Danish Life Guards as a technical sergeant, Michael brings valuable insights to the Board. His expertise in production and leadership, combined with his dedication to Vestas, contributes to the company's success in providing sustainable energy solutions and advancing the wind energy industry. |

| Pia Kirk Jensen | A Danish national, serves as the Global Travel Manager in the People & Culture department at Vestas Wind Systems A/S. She has been an esteemed member of the Vestas Wind Systems A/S Board since 2020, elected by company employees, with a term of office set to expire in 2024.

Given her employment in Vestas Wind Systems A/S, Pia is not considered independent under the Danish Corporate Governance Recommendations. Her educational background includes being a language secretary in English, with open education at HIH Herning, and an office assistant at Vestas Wind Systems A/S. Throughout her extensive career with the Vestas Group, Pia has held various positions, such as Export Sales Assistant, Project Assistant, PA, and Travel Manager. Since 2012, she has dedicated her expertise as the Global Travel Manager, contributing to the company's success in managing global travel operations. With her strong background in the wind energy industry and her role in People & Culture, Pia brings valuable insights to the Board, enhancing Vestas' commitment to providing sustainable energy solutions and driving innovation in the renewable energy sector. |

| Sussie Dvinge | a Danish national, holds the position of Management Assistant in Technology & Service Solutions at Vestas Wind Systems A/S. She has been a member of the Vestas Wind Systems A/S Board since 2005, elected by company employees, with her most recent re-election in 2020, securing a term of four years.

With her extensive experience and expertise, Sussie has been a valuable addition to the Vestas Board, contributing to the company's continued growth and success as a leader in the renewable energy industry. |

Macro analysis edit edit source

In 2022, Vestas experienced a surge in electricity prices, leading to increased value in wind turbine output. However, the company's financial performance was impacted by geo-political uncertainty and high inflation. While the Service segment demonstrated robust performance with a remarkable 27 percent revenue growth and a 21.4 percent EBIT margin, the profitability of the Power Solutions segment decreased to (13.3) percent. In response, Vestas exercised discipline and raised the average selling price of their wind energy solutions.

Special Items

In 2022, Vestas decided to withdraw from the Russian market due to the Russian invasion of Ukraine. The wind-down of operations and termination of contractual relationships ensued. In January 2023, Vestas fully exited Russia, leading to deconsolidation of its Russian entities. The first quarter of 2023 saw a net expense of EUR 3m in special items, which included a EUR 2m gain from the deconsolidation. Additionally, an income of EUR 29m was recognized for adjusting the manufacturing footprint in India, including the reversal of a previously recognised write-down of inventories worth EUR 34m, partly offset by other costs of EUR 5m.

Proftability

In 2022, Vestas reaffirmed its commitment to building a stronger ecosystem with renewables through fewer and larger partnerships integral to their operations and value creation. Despite unexpected challenges, Vestas is on the right strategic path, with the Executive Management team and Board working closely to update and execute their strategy in 2023. Sustaining progress in Service, Development, and Offshore is essential, while profitability in the onshore business remains a priority. With a solid combined order backlog of EUR 49.5bn, Vestas aims to maintain pricing discipline and operational efficiency. As Vestas celebrates its 125-year anniversary in 2023, their goal is to achieve a double-digit EBIT margin by 2025, starting with profitability in 2023. They express gratitude to employees, partners, customers, shareholders, and stakeholders for their collaboration and support. Emphasising the importance of partnerships across the value chain, Vestas aims to industrialize products and address quality challenges to drive the energy transition forward. Their ambition to create a healthier industry persists, demonstrated by the improved customer Net Promoter Score. Vestas remains committed to addressing market fundamentals and acting now to accelerate the transition to a net-zero future through wind energy.

2023 outlook

In 2023, Vestas expects negative impacts on revenue and profitability due to high inflation and reduced wind power installations. Slow permitting in Europe and lower activity in the USA are contributing factors. Despite higher prices on order intake, profitability remains challenging. Vestas emphasizes strengthening commercial discipline and the value chain with partners to improve industry profitability. Revenue outlook ranges from EUR 14.0bn to 15.5bn, including Service revenue growth of at least 5 percent. Vestas targets an EBIT margin before special items of (2)-3 percent with a Service EBIT margin of around 22 percent. Total investments are expected to reach approximately EUR 1bn in 2023, considering uncertainties related to execution. The outlook also reflects the impact of the sale of Vestas' converter factories, with an expected impact on EBIT before special items of around EUR 150m. Vestas' Development business is growing, and income related to sale of Development projects is now included as part of normal operations from January 2023. Potential disruptions in production and shipment, and exchange rate fluctuations, may affect full-year results.

ESG

"Sustainability in everything we do!"

The urgent need to accelerate the sustainable energy transition has been reinvigorated by the dual threats of climate change and energy scarcity driven by Russia's war of aggression. Vestas' technology already contributes significantly to this solution, with their turbines in 2022 alone expected to avoid 408 million tonnes of CO2e emissions while promoting energy independence and job creation. To meet global climate goals, wind energy installations must quadruple by the end of this decade. To achieve this, Vestas recognizes the importance of strategic partnerships to scale sustainable energy solutions while ensuring long-term sustainability through their "Sustainability in everything we do" strategy, encompassing the entire value chain.

Vestas is committed to achieving carbon neutrality across its operations by 2030 without relying on carbon offsets. They are working with strategic suppliers to lower the carbon intensity of their turbines by 45 percent by 2030, achieving this through changes in design, materials procurement, and decarbonizing infrastructure. Vestas aims to create zero-waste wind turbines by 2040 through their Circularity Roadmap, setting interim targets for increased recyclability, material efficiency, decreased supply chain waste, and higher component utilisation. They prioritise safety, aiming to reduce the injury rate by 85 percent by 2030, increase women in leadership positions to 30 percent, and benefit 35,000 community members through CSR projects by 2025. Vestas intends to lead the transition to sustainable energy by electrifying new sectors and campaigning for sustainable change. They seek strategic partnerships to overcome the challenges faced by the renewable energy industry and build a world powered by sustainable energy, promoting a sustainable and resilient energy system for a better future.

Markets

1. Europe: Europe has been a pioneering region in the adoption of renewable energy, with strong commitments to reducing carbon emissions and transitioning to sustainable power sources. Vestas has established a significant market presence in countries like Germany, Spain, and the United Kingdom, where wind energy has become a vital component of the energy mix. European nations' focus on renewable energy targets has created a conducive environment for wind power development.

Despite being a mature market, Europe remains crucial for Vestas due to continuous re-powering efforts, offshore expansion, and the replacement of older turbines with more advanced models. Vestas' longstanding presence in Europe and its ability to adapt to changing regulations and technology advancements have contributed to its market leadership in the region.

2. North America: The United States and Canada have seen substantial growth in wind energy installations over the years. Vestas has been a key player in this market, supplying wind turbines for both onshore and offshore projects. Favorable government policies, such as tax incentives and renewable energy mandates, have driven the growth of wind power in North America.

North America represents a significant market for Vestas, offering opportunities for further growth. The ongoing shift towards renewable energy sources, driven by environmental concerns and energy security, has spurred investments in wind power. Vestas' strong project execution capabilities and reputation for delivering reliable turbines have positioned the company well in this competitive market.

3. Latin America: Latin America is witnessing a growing interest in wind energy as countries seek to diversify their energy mix and reduce dependence on fossil fuels. Brazil, Mexico, and Argentina have emerged as key markets for wind power installations, attracting investments from major players like Vestas.

Vestas' expansion in Latin America aligns with the region's increasing focus on sustainable energy solutions. As Latin American countries continue to promote renewable energy through auctions and incentives, Vestas' technological expertise and experience in developing wind projects offer a competitive advantage. Strategic investments in this region can provide Vestas with substantial growth opportunities in the coming years.

4. Asia-Pacific: The Asia-Pacific region, particularly China and India, is witnessing rapid growth in the wind energy sector. Factors such as increasing urbanisation, industrialisation, and concerns over air pollution have driven the demand for cleaner energy sources.

Vestas has recognised the immense potential of the Asia-Pacific market and has been actively pursuing opportunities in China and India. The region's ambitious renewable energy targets and favourable policies have attracted major investments in wind power infrastructure. Vestas' continued focus on localisation, partnerships with local suppliers, and adapting to regional regulations will be crucial in maintaining a competitive edge in this dynamic market.

5. Rest of the World: Vestas also has a presence in various other markets across the globe, including Africa and the Middle East. These regions offer untapped potential for wind energy development, driven by increasing energy demands and a desire to reduce reliance on fossil fuels.

While the Rest of the World markets might not be as mature as Europe and North America, they present exciting growth opportunities for Vestas. The company's global experience and track record in diverse environments give it an advantage in expanding its reach in emerging wind energy markets. As these regions prioritise sustainability and energy security, Vestas' presence and technological expertise can play a pivotal role in meeting their renewable energy goals.

Overall, Vestas Wind Systems' strategic focus on key markets aligns with the global shift towards renewable energy and sustainability. The company's established market presence, continuous innovation, and commitment to delivering reliable and efficient wind turbines position it as a leading player in the wind energy industry worldwide. However, the market dynamics are continually evolving, and competition remains fierce, necessitating Vestas to remain agile and adaptive in its market strategies.

| Geographical Distribution of revenue | ||

|---|---|---|

| 2022 | 2021 | |

| EMEA | 7,826 | 8,818 |

| Americas | 5,111 | 4,807 |

| Asia Pacific | 1,549 | 1,962 |

| Total | 14,486 | 15,587 |

Breakthrough in blade recycling

Vestas, in collaboration with partners Aarhus University, Danish Technological Institute, Olin, and supported by Stena Recycling, has achieved a significant breakthrough in blade recycling. Turbine blades made with epoxy resin, which were previously challenging to recycle, can now be rendered circular without changing their design or composition. The novel chemical disassembly process breaks down epoxy resin into virgin-grade materials, paving the way for a circular economy for existing and future blades. With around 25,000 tonnes of blades reaching the end of their operational life annually by 2025, this solution offers a sustainable alternative to landfill disposal. As the process utilises widely available chemicals, industrialisation can occur efficiently and cost-effectively. A pilot project will initiate the operationalisation of the partnership and construction of new recycling facilities, leading to a scalable circular blade recycling solution. This breakthrough not only helps the wind industry but also opens possibilities for broader circular economy practices across different sectors. Vestas remains dedicated to driving sustainability through innovative collaboration with strategic partners.

Issuing the first sustainability-linked bonds in Denmark

Vestas achieved a significant milestone by issuing the first sustainability-linked bonds in Denmark, totalling EUR 1 billion. This ground-breaking initiative integrates sustainability with financial targets, reinforcing Vestas' commitment to environmental responsibility. The bonds' fixed rate is directly tied to the company's progress in three crucial areas: reducing carbon footprint in its operations , lowering carbon intensity in the supply chain, and increasing material efficiency. By openly sharing the full sustainability-linked bond framework on their corporate website, Vestas demonstrates transparency and accountability to stakeholders. This move enables investors and shareholders to actively engage with Vestas' efforts to minimise negative environmental impacts and promote sustainability. The innovative financing approach allows Vestas to accelerate the green transition while broadening its investor base and reducing execution risk. This bold step exemplifies Vestas' leadership in integrating sustainability into their business strategy and sets a clear path for other companies to follow suit.

Risks edit edit source

Credit risk

- Vestas manages credit risks in accordance with the Treasury Policy, considering exposures from cash and cash equivalents, marketable securities, derivative financial instruments, and trade receivables. Limits for credit risk exposure are set based on counter-parties' credit ratings or mitigating actions

- As of December 31, 2022, Vestas' maximum credit risk related to financial institution counter-parties is EUR 2,473m, and the total credit risk is EUR 5,719m.

- Trade receivables and contract assets are mainly with energy sector counter-parties, and credit risk is assessed based on historical loss rates, current information, and individual assessment. Vestas groups trade receivables based on loss patterns to assess expected credit losses.

- As of December 31, 2022, 59 percent of trade receivables and contract assets are in EMEA, 30 percent in America, and 11 percent in Asia Pacific. No single customer accounts for more than 10 percent of total trade receivables.

- Vestas mitigates commercial credit risk through received security, such as third-party guarantees, and historically, the company has not incurred significant losses on trade receivables.

- 92 percent of Vestas' exposure to financial institutions is with counter-parties with a credit rating in the range of A to AAA. The company has ISDA agreements with financial institution counter-parties for derivative financial instruments, limiting actual credit risk to net assets per counter-party.

Market Risks

- Vestas is exposed to market risks, including foreign currency risks, commodity price risks, and interest rate risks, which are managed in accordance with the Treasury Policy.

- Foreign currency risks arise from transactions in currencies other than the functional currency, primarily from material purchases and wind turbine sales. Vestas hedges foreign currency exposures related to firm wind turbine orders and monetary balances.

- The majority of Vestas' sales are in USD and EUR, and the company reduces foreign currency risk by centralising exposures in Vestas Wind Systems A/S and sourcing materials and components in USD.

- Commodity price risks mainly relate to fluctuations in raw materials used in wind turbine production. The risk is managed by fixed price agreements with suppliers and commodity swaps.

- Interest rate risk is related to interest-bearing debt with floating rates and cash and cash equivalents. As of December 31, 2022, a 1%-point increase in relevant interest rates would have increased profit before tax by EUR 19m.

Investment Risks edit edit source

1. Market and Economic Risks: Vestas' financial performance is influenced by the global wind energy market and macroeconomic conditions. Factors such as changes in demand for renewable energy, government policies, and economic downturns can impact Vestas' revenue and profitability.

2. Technological Competition: Vestas operates in a competitive industry, and technological advancements or innovations by competitors could affect its market share and pricing power.

3. Supply Chain and Production Risks: Vestas relies on a complex global supply chain to manufacture its wind turbines. Any disruptions or delays in the supply of raw materials or components could impact production and delivery schedules.

4. Project Execution and Delays: Vestas' revenue is dependent on successfully executing wind energy projects. Delays in project installations or unexpected project cancellations can affect financial results.

5. Foreign Exchange Risks: As an international company, Vestas is exposed to foreign exchange rate fluctuations. Currency volatility can impact its financial results and create uncertainties.

6. Regulatory and Policy Risks: Changes in government policies related to renewable energy, subsidies, or tariffs can have significant impacts on Vestas' business operations and profitability.

7. Environmental Risks: As a company involved in renewable energy, Vestas faces environmental risks related to climate change and environmental regulations.

8. Financial Risks: Vestas' financial stability can be influenced by interest rate fluctuations, credit risks, and debt levels.

9. Strategic Risks: Strategic decisions and expansion plans can involve uncertainties and risks if not executed effectively.

10. Geopolitical Risks: Vestas' operations in various regions expose it to geopolitical risks, including trade disputes, political instability, and changes in international relations.

Financial Risk Management edit edit source

- Vestas has a comprehensive policy for managing financial risks, which is an integral part of its operating activities. Financial risks are monitored and managed centrally, and the Treasury Policy outlines the objectives and policies for financial risk management. The policy sets limits for various financial risks and only allows the use of derivatives to hedge commercial exposures, avoiding speculative transactions.

- The Board and Executive Management regularly assess Vestas' capital structure to achieve the necessary flexibility and stability for strategic development while maintaining a target net interest-bearing debt/EBITDA ratio below 1x.

- Vestas manages liquidity risks in line with the Treasury Policy to ensure sufficient financial resources to meet financial obligations. This includes managing financial resources through cash, money market deposits, credit facilities, and marketable securities.

- In 2022, Vestas established a EUR 3,000m EMTN programme to strengthen liquidity and long-term funding access. The company has a EUR 2,000m committed revolving multi-currency credit facility and uncommitted money market facilities to manage short-term liquidity.

- To further enhance funding, Vestas issued two EUR 500m sustainability-linked bonds with maturities in 2029 and 2034 and drew EUR 475m from a green loan facility granted by the European Investment Bank to support research, development, and innovation activities. The EMTN programme still has a capacity of EUR 2,000m.

Competitors edit edit source

1. Siemens Gamesa Renewable Energy: edit edit source

Siemens Gamesa is a global leader in the wind energy industry and a major competitor to Vestas. The company was formed through the merger of Siemens Wind Power and Gamesa in 2017. Siemens Gamesa offers a wide range of wind turbines for both onshore and offshore applications. It has a strong global presence and is actively involved in projects across Europe, Americas, Asia-Pacific, and Africa. The company's technological advancements and efficient turbines have made it a formidable competitor in the market. Siemens Gamesa also provides services, maintenance, and renewable energy solutions to its customers, making it a comprehensive player in the industry.

2. General Electric (GE) Renewable Energy: edit edit source

GE Renewable Energy is a division of General Electric, a multinational conglomerate with a significant presence in the renewable energy sector. GE Renewable Energy offers a diverse portfolio of onshore and offshore wind turbines. The company's wind turbines are known for their high efficiency and reliability. GE has been a pioneer in the development of direct-drive technology, which has contributed to its competitiveness in the industry. GE Renewable Energy is active in various global markets, including the United States, Europe, and Asia. Additionally, the company's extensive experience in power generation and grid solutions gives it a unique advantage in integrating wind energy into the overall energy ecosystem.

3. Goldwind: edit edit source

Goldwind is a Chinese wind turbine manufacturer and one of the leading players in the wind energy market. It is well-established in China, the world's largest wind energy market, and has been expanding its presence globally. Goldwind offers a diverse range of wind turbines for onshore and offshore applications. The company's competitive advantage lies in its strong domestic market position and its ability to offer cost-effective solutions. Goldwind has also been expanding its international footprint, securing projects in countries like Australia, the United States, and Latin America. Additionally, Goldwind's focus on research and development has allowed it to enhance the performance and efficiency of its wind turbines.

Cash Flows edit edit source

1. Net Working Capital:

As of 31 December 2022, Vestas had a net liability of EUR 1,349m in net working capital, representing a negative development of EUR 300m compared to the end of 2021. The increase in inventory level during 2022 was offset by rising prepayments.

2. Cash Flow from Operating Activities:

Cash flow from operating activities was negative EUR 195m in 2022, decreasing by EUR 1,151m compared to 2021. The negative profit in 2022 impacted the cash flow, but this was partly offset by the improvement in net working capital.

3. Cash Flow from Investing Activities:

Cash flow from investing activities before acquisitions of subsidiaries, joint ventures, associates, and financial investments resulted in a net outflow of EUR 758m in 2022, slightly lower than the net outflow of EUR 773m in 2021. The decrease in net investments was mainly due to reduced investments in transportation equipment and construction tools, partially offset by increased investments in V236-15.0 MW offshore technology and cash inflow from the disposal of the Lauchhammer production facilities.

4. Free Cash Flow:

Free cash flow before acquisitions of subsidiaries, joint ventures, associates, and financial investments amounted to negative EUR 953m in 2022, significantly lower than the EUR 183m in 2021. The decline was primarily driven by the negative cash flow from operating activities.

5. Strategic Acquisitions and Divestments:

In August 2022, Vestas agreed to sell its controls & converter business, including three factories and associated staff functions, to KK Wind Solutions. The transaction, expected to be completed in Q1 2023, classified the assets as held for sale as of 31 December 2022. The sale is anticipated to impact EBIT before special items by approximately EUR 150m.

Value-adding investments

Over the last five years, we have invested in a new modular platform, and taken full ownership of the offshore business.

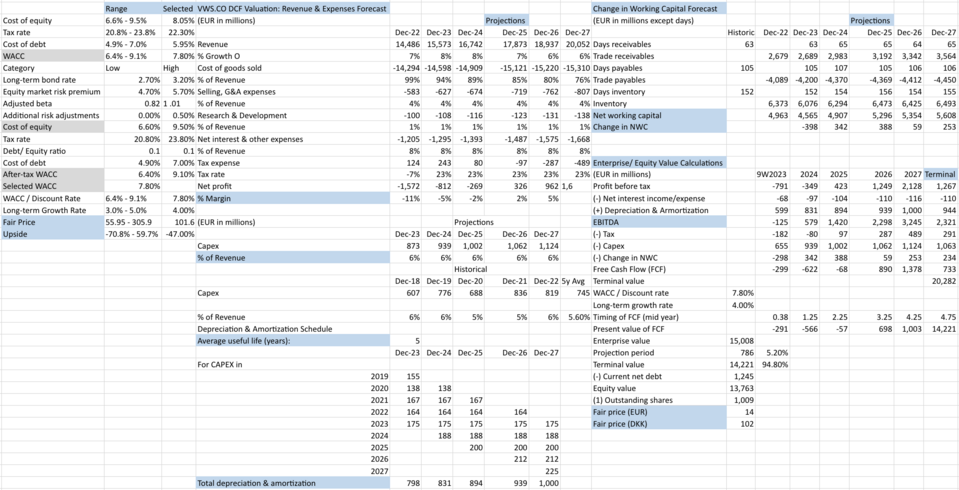

DCF edit edit source

Financial performance edit edit source

1. Administration costs:

In 2022, administration costs amounted to EUR 351m, representing 2.4 percent of revenue. The decrease from 2021 was mainly due to offshore integration activities impacting the previous year.

2. Depreciation, amortisation, and impairment:

Depreciation, amortisation, and impairment in 2022 totaled EUR 1,089m before special items, an increase from EUR 914m in 2021. The rise was primarily due to the impairment of the V164/V174 offshore technology and related assets, along with other minor impairments.

3. Operating profit (EBIT):

EBIT before special items was negative EUR 1,152m in 2022, down from EUR 428m in 2021. The EBIT margin before special items decreased by 10.8 percentage points compared to the previous year, driven by lower revenue and gross profit margin.

4. Income from investments in associates and joint ventures:

Income from investments in associates and joint ventures amounted to a net profit of EUR 10m in 2022, down from EUR 36m in 2021. The decrease was related to lower development activities in the USA and impairment of projects in Latin America, partially offset by higher income from investments in Copenhagen Infrastructure Partners P/S.

5. Net financial items:

Financial items in 2022 were negative EUR 110m, slightly higher than the negative EUR 101m in 2021, including interests, fees, and currency-related items.

6. Income tax:

Income tax amounted to positive EUR 124m in 2022, a significant change from negative EUR 81m in 2021. The effective tax rate was 7.4 percent, primarily influenced by non-deductible costs relating to the Russia and Ukraine conflict and updated valuation of tax assets in the USA and Denmark.

7. Net loss for the year:

In 2022, Vestas reported a net loss of EUR 1,572m, in contrast to a net income of EUR 143m in 2021. The loss was mainly due to the diluted EBIT margin and high levels of costs classified as special items.

8. Profitability ratios:

Earnings per share in 2022 were negative EUR 1.6, down from EUR 0.1 in 2021, reflecting the net loss. Return on capital employed (ROCE) was negative 18.5 percent in 2022, a significant decrease from 4.5 percent in 2021. Return on equity was negative 43.9 percent, reflecting the lower profit for the year.

edit edit source

1. Equity and Solvency Ratio:

As of 31 December 2022, Vestas' total equity decreased to EUR 3,060m, attributed to a negative net result of EUR 1,572m and dividend payment of EUR 50m to shareholders. The solvency ratio also declined to 15.2 percent, a decrease of 8.7 percentage-points from the previous year, reflecting the decreasing equity.

2. Net Interest-Bearing Position and Cash Position:

As of 31 December 2022, Vestas had EUR 2,378m in cash and cash equivalents, and net interest-bearing debt was positive at EUR 46m, a decrease of EUR 1,154m compared to 2021. This was due to the issuance of sustainability-linked bonds to refinance a green bond and secure long-term funding, along with a green loan facility with the European Investment Bank (EIB) to fund research, development, and innovation activities.

3. Distribution to Shareholders:

The Board of Directors' general intention is to recommend a dividend of 25-30 percent of the company's annual net result after tax. However, no dividends were recommended for distribution based on the negative annual result in 2022.

4. The Financial Year 2022:

Vestas has been authorised to acquire treasury shares, not exceeding 10 percent of the share capital, until 31 December 2023. No treasury shares were acquired in 2022.

edit edit source

During 2018 there was a reduction of share capital by DKK 9,800,944 nominally by cancelling 9,800,944 shares from Vestas’ holding of treasury shares. During 2019, there was

a reduction of share capital by DKK 6,974,040 nominally by cancelling 6,794,040 shares from Vestas’ holding of treasury shares. During 2020, there was a reduction of share capital

by DKK 1,977,848 nominally by cancelling 1,977,848 shares from Vestas’ holding of treasury shares. Vestas Wind Systems A/S has completed a capital increase of nominally DKK 5,049,337, representing 5,049,337 shares of nominally DKK 1 each. During 2021, a share split of Vestas’ shares with a ratio 1:5 was carried out with effect as of 28 April 2021. Consequently, each share of nominally DKK 1.00 was split into five new shares of nominally DKK 0.20. Except for these six transactions, the share capital has not changed in the period 2018-2022. All shares rank equally.

| Number of shares | 2022 | 2021 |

|---|---|---|

| Number of shares as at 1 January | 1,009,867,260 | 201,973,452 |

| Share split 1:5 | - | 807,893,808 |

| Number of shares as at 31 December | 1,009,867,260 | 1,009,867,260 |

| Shares outstanding | 1,006,177,558 | 1,005,144,100 |

| Treasury shares | 3,689,702 | 4,723,160 |

| Number of shares as at 31 December | 1,009,867,260 | 1,009,867,260 |

| Vestas Wind Systems A/S has acquired treasury shares as follows | ||

| Average share price, purchases (DKK) | - | 237 |

| Purchase amount (mEUR) | - | 12 |

Financial highlights - 2022 Results edit edit source

1. Revenue:

In 2022, Vestas' revenue amounted to EUR 14,486m, a decrease of 7.1 percent compared to 2021. The decline was primarily due to challenges in the Power Solutions segment, with transportation and project execution delays impacting deliveries in most regions. However, there was a partial offset by increasing Service revenue. Revenue in EMEA accounted for 54 percent, down from 56 percent in 2021, while the Americas' share increased to 35 percent from 31 percent. Asia Pacific contributed 11 percent of the revenue in 2022, down from 13 percent in the previous year.

2. Gross Profit:

The gross profit in 2022 was EUR 118m, with a gross margin of 0.8 percent, a 9.2 percentage point decrease compared to 2021. Gross profit was negatively affected by external cost inflation and supply chain disruptions in the Power Solutions segment. Warranty provisions also impacted the gross profit margin due to increased repair and upgrade costs related to external factors and specific cases, along with additional costs related to offshore technology.

3. Warranty Provisions:

The warranty costs in 2022 amounted to EUR 930m net of supplier claims, representing 6.4 percent of revenue, an increase of 2.0 percentage points from 2021. The higher warranty level was mainly due to repair and upgrade costs influenced by external cost inflation and supply chain disruptions. Additional costs related to the V164/V174 offshore technology also contributed to the warranty provisions.

4. Research and Development Costs:

Research and development costs recognised in the income statement were EUR 457m, with an increase from EUR 389m in 2021. The rise was primarily due to impairment losses on the V164/V174 offshore technology. Total research and development expenditure before capitalisation and amortisation also increased to EUR 514m, primarily attributed to investments in the V236-15.0 MW offshore technology.

5. Distribution Costs:

Distribution costs in 2022 amounted to EUR 462m, up from EUR 371m in 2021. The increase was mainly driven by higher depreciation on transportation equipment and additional equipment costs, along with increased sales promotion activity and impairment losses on the V164/V174 offshore technology.

Income Statement edit edit source

| mEUR | 2022 | 2021 |

|---|---|---|

| Revenue | 14,486 | 15,587 |

| Production costs | 14,368 | 14,031 |

| Gross profit | 118 | 1,556 |

| Research and development costs | 457 | 389 |

| Distribution costs | 462 | 371 |

| Administration costs | 351 | 368 |

| Operating profit (EBIT) before special items | 1,152 | 428 |

| Special items | 444 | 139 |

| Operating profit (EBIT) | 1,596 | 289 |

| Income/(loss) from investments in joint ventures and associates | 10 | 36 |

| Financial income | 52 | 21 |

| Financial costs | 162 | 122 |

| Profit before tax | 1,696 | 224 |

| Income tax | 124 | 81 |

| Profit for the year | 1,572 | 142 |

| Profit is attributable to: | ||

| Owners of Vestas Wind Systems A/S | 1,572 | 134 |

| Non-controlling interests | 0 | 9 |

| Earnings per share (EPS): | ||

| Earnings per share (EUR) | 1.56 | 0.13 |

| Earnings per share (EUR), diluted | 1.56 | o.13 |

Balance sheet edit edit source

| Assets | liabilities | ||||

|---|---|---|---|---|---|

| mEUR | 2022 | 2021 | 2022 | 2021 | |

| Intangible assets | 3,065 | 3,062 | Share capital | 27 | 27 |

| Property, plant and equipment | 1,752 | 2,091 | Other reserves | 15 | 22 |

| Investments in joint ventures and associates | 646 | 609 | Retained earnings | 3,002 | 4,635 |

| Other investments | 88 | 81 | Equity attributable to Vestas | 3,044 | 4,684 |

| Tax receivables | 100 | 229 | Non-controlling interests | 16 | 13 |

| Deferred tax | 497 | 378 | Total equity | 3,060 | 4,697 |

| Other receivables | 219 | 234 | Provisions | 944 | 686 |

| Financial investments | 95 | 100 | Deferred tax | 158 | 362 |

| Total non-current assets | 6,462 | 6,784 | Financial debts | 2,179 | 732 |

| Inventories | 6,373 | 5,673 | Tax payables | 177 | 326 |

| Trade receivables | 1,280 | 1,531 | Other liabilities | 59 | 145 |

| Contract assets | 1,399 | 1,227 | Total non-current liabilities | 3,517 | 2,251 |

| Contract costs | 753 | 690 | Financial debts | 248 | 704 |

| Tax receivables | 51 | 102 | Contract liabilities | 6,937 | 6,180 |

| Other receivables | 1,221 | 1,105 | Trade payables | 4,089 | 4,286 |

| Financial investments | - | 116 | Provisions | 829 | 646 |

| Cash and cash equivalents | 2,378 | 2,420 | Tax payables | 58 | 75 |

| Assets held for sale | 173 | - | Other liabilities | 1,349 | 809 |

| Total current assets | 13,628 | 12,864 | Liabilities related to assets held for sale | 3 | - |

| Total assets | 20,090 | 19,648 | Total current liabilities | 13,513 | 12,700 |

| Total liabilities | 17,030 | 14,951 | |||

| Total equity and liabilities | 20,090 | 19,648 | |||

Financial Assets and Liabilities edit edit source

- The fair value of financial assets and liabilities, measured at amortized cost, is not significantly different from their carrying amount, except for financial debt instruments.

- Financial investments consist of interest-bearing investments that are recognized at fair value upon initial recognition. They are subsequently measured at amortized cost if held to collect, or at fair value through profit or loss if held to sell.

- Other investments include non-listed equity shares and rental deposits, which are designated at fair value through profit and loss.

- Financial debts at December 31, 2022, include a green loan facility, sustainability-linked bonds, other credit facilities, and lease liability. The fair value of sustainability-linked bonds at this date is also mentioned.

- As of December 31, 2021, financial debts included a bilateral bridge facility, other credit facilities, and lease liability.

Other operating assets and liabilities edit edit source

Development projects and other intangible assets

Vestas continually invests in the development of new technologies and, for this reason, development projects constitute a significant part of the total intangible assets. The continuous investments include a wide portfolio of development projects. Vestas does not have one individually significant development assets.

Impairment relating to offshore activity

In 2022, Vestas recognised an impairment loss of EUR 177m relating to the V164/174 offshore activity, impacting the Power Solution segment by EUR 165m and the Service segment by 12m. Intangible assets, including technology, were written down by EUR 96m to EUR 439m and tangible assets were written down by EUR 81m to EUR 113m, reflecting the recoverable amount of the assets.

The recoverable amount is based on the discounted value

of future expected cash flows from the offshore activity. A discount rate before tax of 9.8% was used. The impairment was primarily due to revised assumptions on offshore order intake and project profitability. The test remains sensitive to changes in key assumptions, including order intake, project margins and service margins. A change in order intake will have a significant impact on the recoverable amount. A change of 1%-point in the assumed project margin will result in a

EUR 15m change to the recoverable amount and a change of 1%-point in the service margin will result in a EUR 22m change to the recoverable amount.

Intangible assets

1. Estimates of Future Cash Flows for MVOW Assets: As part of the acquisition of MHI Vestas Offshore Wind (MVOW), Vestas tested the acquired intangible and tangible assets for impairment as of 31 December 2022. The impairment test compared the carrying amount of assets to the discounted value of expected future cash flows from the offshore activity (value-in-use), based on key assumptions subject to significant uncertainty.

2. Goodwill: Goodwill, the difference between the fair value of net assets acquired and the consideration transferred, is initially recognized and subsequently measured at this value less accumulated impairment losses. It is allocated to Vestas' operating segments and tested at least annually for impairment. Impairment losses on goodwill are recognized in the income statement and not reversed.

3. Development Projects: Projects for the development and testing of new wind turbines are recognised as intangible assets if they meet specific criteria, intending future commercial purposes. Development costs not qualifying for capitalisation are recognised in the income statement as research and development costs. Amortisation of development projects occurs on a straight-line basis over their estimated useful lives, tested for impairment at least annually.

4. Patents and Licenses: Patents and licenses included in development projects are measured at cost less accumulated amortisation and impairment losses, amortised over their respective periods.

5. Software: Acquired and internally developed software is measured at cost less accumulated amortisation and impairment losses, amortised on a straight-line basis over three to five years.

6. Other Intangible Assets: Customer relationship, order backlog, and trademarks with finite useful lives acquired from third parties are capitalised at cost and amortised over their remaining useful lives. Other intangible assets not falling under these categories are measured at cost less amortisation and impairment losses.

Growth Drivers edit edit source

| Carbon neutrality | Zero waste | Social responsibility | Leading the transition |

|---|---|---|---|

| Green electricity Source electricity from renewable sources

Green service fleet Transition of benefit cars, service vehicles, and offshore vessels to run on renewable electricty or sustainable fuels Industrial heating Transition to electricity, district heating, or biofuels Emission-reduced steel Focus on accelerating the decarbonisation of steel used in our turbines Suppliers Help decarbonise our supply chain by setting targets and sharing knowledge |

Circular blades

Scale up recycling solutions and design circular blades Internal waste Increase the material efficiency of our manufacturing operations and cease landfilling and incineration Component repair and refurbishment Expand and regionalise our repair and refurbishment infrastructure Suppliers Reduce supply chain waste by setting targets and sharing knowledge |

Safety

Decrease our lost time and recordable injury rates and avoid all fatalities Diversity, equity, inclusion and belonging Increase the percent of women in leadership and foster inclusion for people of all social identities Affected communities Increase the number of community beneficiaries reached through engagement initiatives in areas impacted by our activities |

Electrification

Increase the share of global energy demand met by electricity, including the expansion of decarbonised transporation through EV's and Power-to-X technology Sustainable policy Campaign for a sustainable scale-up of renewable energy by aligning climate and sustainability commitments with effective policy |

Conclusion edit edit source

In conclusion, Vestas Wind Systems presents a compelling investment opportunity in the rapidly growing renewable energy sector, particularly in wind power. As a leading manufacturer of wind turbines, the company is well-positioned to capitalize on the increasing global demand for clean and sustainable energy solutions. Vestas' strong global presence, with installations in numerous countries, demonstrates its ability to secure projects across diverse markets.

The company's commitment to sustainability and ongoing investments in research and development underscore its dedication to technological innovation and operational efficiency. Furthermore, its diverse portfolio of renewable energy solutions, including service and maintenance offerings, enhances its revenue streams and customer relationships.

One significant consideration for potential investors is the stock price. As of 28th July 2023 , the stock price of Vestas stood at £24.67. However, it's important to note that stock prices are subject to market fluctuations and can be influenced by various factors, including industry trends, financial performance, and macroeconomic conditions.

Although Vestas presents a promising investment opportunity, it is essential for investors to conduct thorough due diligence and carefully evaluate their risk tolerance before making investment decisions. The renewable energy sector is subject to regulatory changes, technological advancements, and competitive pressures that can impact the company's financial performance and stock price.

Overall, with its strong market position, focus on sustainability, and expertise in wind energy solutions, Vestas Wind Systems merits serious consideration as an investment opportunity for investors seeking exposure to the growing renewable energy industry.