Visa Inc.

| |

Former headquarters at Metro Center in Foster City, California | |

| Type | Public |

|---|---|

| Industry | Financial services |

| Founded | September 18, 1958 (as BankAmericard in Fresno, California, U.S.) |

| Founder | Dee Hock |

| Headquarters | One Market Plaza, San Francisco, California, U.S.[1] |

Area served | Worldwide |

Key people |

|

| Products | |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | c. 26,500 (2022) |

| Website | |

| Footnotes / references Financials as of September 30, 2022[update]. References:[3] | |

Visa Inc. is a global payments technology leader. Serving consumers, merchants, financial institutions, businesses, strategic partners, and governments, the company stands at the forefront of digital payments. Its core infrastructure, VisaNet, ensures seamless authorization, clearing, and settlement of payment transactions. Beyond this, Visa provides an array of card products, platforms, and value-added services under renowned brands such as Visa, Visa Electron, Interlink, VPAY, and PLUS.

Founded in 1958, Visa now commands a formidable 40% of the global payment processing market share. Its robust digital transaction processing system is hailed as the industry's most secure and reliable, validating its $500 billion net worth. The uniqueness of Visa's network and its indispensability in the financial landscape safeguard its fiscal strength.

For the past 15 years, Visa has consistently outperformed its competitors, witnessing an impressive growth in net income. It stands as a testament to its excellence, currently ranking as the 10th most valuable company globally. Investors can find Visa listed on the New York Stock Exchange, S&P 500, and Dow Jones Industrial Average, with its stock priced at $240 per share.

According to both Discounted Cash Flow and Multiples valuation methods, Visa Inc.'s stock is undervalued, making it a strong buy recommendation.

Introduction edit edit source

Visa Inc is a American multinational financial services corporation specialising in providing services to large scale financial businesses. Their main service is to provide digital transactions between merchants and consumers by providing financial institutes with Visa branded products. As Visa is a global payments technology company they are reliant only on their cloud infrastructure rather than any specific suppliers. They also cater to smaller businesses specifically with their newer products such as their small business toolkit, their analytics platform or their consulting services. The company also produces ongoing improvements to their main existing product: digital transactions, namely their “3D Secure”, the “Visa Token Service” or even their numerous analytical intelligence solutions. Founded in 1958 as part of the “BankAmericard” Credit Card Program by the Bank of America, it immediately displayed its practicality in a time where America was plagued with revolving credit accounts from several different merchants as it provided a unified financial and appeared to be the first successful “all purpose credit card”. After a few years of refining, by 1961 the BankAmericard Program had become profitable and, due to the confidentiality of its success, it had no competitors until 1966. Rebranded as “Visa” in 1976 and remained as such till the present it has become one of the world's most valuable companies, boasting a net worth of $494.97 billion as of August 2, 2023 and $505.17 billion as of August 10, 2023.

As of today Visa provides digital payments across more than 200 countries and territories connecting consumers, merchants, financial institutions and businesses. In 2021, the Visa market share was 39% meaning they accounted for almost two-fifths of all credit card purchases worldwide. The runner-up UnionPay has a slightly lower share by purchase transactions than Visa’s market. In 2021, 34% of global credit card purchases were made using UnionPay. MasterCard was the third most popular card brand worldwide. This brand stood behind 24% of all credit card transactions. UnionPay also focuses almost solely on China and due to their domestic approach Visa has the ability to grow significantly on a global scale whereas their main competitor cannot.(Due to the nature of their business model of providing services to financial institutions, a common misconception is the assumption that Visa issues physical cards/credit/rates/fees although they only provide the service of monetary transactions.)

Business Model edit edit source

As Visa is primarily a technological company, providing the world’s largest electronic payments network, their business model is now only heavily reliant on their cloud infrastructure to maintain their users as well as its ability to scale as they increase their payload. Visa generates income through the fees it charges financial institutions and merchants for accessing its network, as well as the fees it charges consumers who use Visa-branded cards.

Due to Visa’s immense success over the past 60 years they no longer need to focus on advertisement to promote their product as long as they continue to provide the most successful form of electronic payments network across the world. As Visa already holds the vast majority of the market share in their sector (over 50%), they no longer need to focus on expansion as their network can be scaled according to how their users grow. Considering their client-base consists of most commerce worldwide (an ever growing sector), their product appears essential for the foreseeable future.

As stated earlier, Visa’s primary strategy is to accelerate revenue growth in consumer payments, new flows and value added services, and fortify the key foundations of our business model: the core electronic payments processing network. Their network consists of 250 million lines of custom built code and operates at a 99.9999% or above availability. It facilitates payments in over 200 countries and territories and has a network covering over 2000 sites and 5800 circuits. The network is built to process up to 76 thousand transactions per second and millions in a day. To ensure safety and constant accessibility, nearly all Visa transactions worldwide are processed through the company's directly operated VisaNet at one of four secure data centres, located in Ashburn, Virginia; Highlands Ranch, Colorado; London, England; and Singapore. These facilities are heavily secured against natural disasters, crime, and terrorism; can operate independently of each other and from external utilities if necessary; and can handle up to 30,000 simultaneous transactions and up to 100 billion computations every second.

Their current products consist of six Visa Credit Cards, the standard Visa Debit Card, Visa Electron, Visa Cash (A Visa-branded stored-value card), Visa Contactless, mVisa and Visa Checkout; all Visa payment methods utilise their electronic network. Visa now also provides various consulting/analytics services as well as automation and tools for smaller businesses. Although Visa makes a majority of its income through services as a middleman between financial institutions and merchants, it also creates additional value through other sources. The corporation generates income through interest and investments, foreign exchange, and other streams; Visa’s net income through all of its various sources totalled $14.9b in 2022 and $12.3b in 2021. Visa’s principal clients are individual and commercial clients, financial institutions such as banks and credit unions, government entities, and merchants.

Industry Overview edit edit source

As previously stated, due to the nature of its target market being substantially involved in worldwide commerce, Visa’s position as the largest global digital payment technology company in an indispensable industry both guarantees its future and its success. In this industry the total addressable market is any trade or commerce with non-cash based transactions worldwide of which Visa currently has a market share of roughly 40%. 34% of the available worldwide market is currently dominated by UnionPay International mainly due to their influence in the Chinese market. Although technically “possible”, it would be extremely unlikely and not worth the risk for Visa to invest into the Chinese transactions services market as the investment required would not lead to a guaranteed increase in market share. Alternatively, Visa chooses to strengthen its existing business model in order to claim market share from its main “real” competitor MasterCard (24% market share) as well as smaller competitors such as PayPal and American Express. Visa and Mastercard are by far the largest and cover above 80% of the global market share excluding China, however, Visa shows the highest net income in comparison to its alternative service providers and has done so for multiple years due to its effective infrastructure and electronic network.

Visa’s key strengths over its major competitor MasterCard is that Visa cards offer a few more benefits such as their “Lost or Stolen Card Reporting”, insurance options, “special guest” status at luxury hotels, roadside dispatch and other perks. Visa and Mastercard are both accepted almost anywhere in the world unlike other competitors. Yet Visa is the highest valued out of all of its competitors with the highest net income (generating $14.9b in 2022.) with a return of 15.85% year-to-date (YTD) and 13.94% in the last 12 months. Over the past 10 years, Visa Inc. had an annualised return of 19.09%, outperforming the S&P 500 benchmark which had an annualised return of 10.28%.

Porter's Five Forces:

Threats of New Entrants: Visa faces a MODERATE threat of new entrants as there are high barriers to entry, including the high capital requirements needed to establish a payment technology infrastructure. Moreover, the payment technology industry is highly regulated, and new entrants must comply with complex regulatory requirements, which are both costly and time-consuming. Furthermore, the established networks of payment technology companies, Visa, are difficult to develop for new players. The companies have extensive networks of banks, merchants, and consumers, making it difficult for new entrants to establish a foothold in the market. Visa’s strong brand reputation and market share also make it difficult for new players to enter and gain market share.

Bargaining Power of Suppliers: The bargaining power of suppliers for Visa is LOW. While Visa does rely on suppliers for certain components and services, the number of suppliers is relatively large, and has no significant concentration of power. Therefore, the bargaining power of suppliers is low. Moreover, due to the strong relationships with its suppliers Visa is able to negotiate favourable terms and pricing due to its large scale and market position. Additionally, there are numerous competitors in the payment technology industry, and suppliers can be easily switched to get favourable terms and pricing.

Bargaining Power of Buyers: The bargaining power of buyers for Visa is HIGH, as customers have a wide range of choices and can easily switch to another provider if unsatisfied with Visa’s offerings. Many of Visa’s customers are large and powerful institutions with significant purchasing power. These customers can negotiate favourable terms and pricing with Visa or switch to a competitor if unsatisfied with the current arrangement.

Threats of Substitutes: Mastercard, American Express, PayPal, and other companies, offer similar services to Visa, thus the threats of substitutes is quite high.

Industry Rivalry: The industry rivalry for Visa is intense, as Visa competitors often use aggressive marketing strategies to gain market share and customer loyalty. As well, the payment solutions market is highly regulated, and there are high entry barriers to new players, resulting in high competition among existing players.

Financials edit edit source

Discounted Free Cash Flow to Firm Method

The DCFF is a forward-looking valuation approach. Therefore, in order to derive the target price, several assumptions have been made in the three main pillars that sustain this method: Free cash flows – the 2020 – 2022 data is based on Visa Inc annual report and the data onward is based on the historical growth rate. To forecast the free cash flow, we made the following assumptions based on our analysis:

- Revenue: were forecasted on the past 3 year’s sales growth % with an average of 13.94% in 2023 and increasing to 16.33% in 2027, reaching USD $62B.

- EBIT Margin: the historic average EBIT margin was 68%, therefore for the purpose of calculating the FCF, an average of 68% EBIT margin is used.

- Depreciation and Amortization: Inline with the historic growth rate, depreciation and amortization expenses are increasing by an average 3.17%.

- Capex: As an asset light model, Visa is expected to keep about 11.42% of revenues as capital expenditures (CAPEX) in the future. The company’s capex was about 12.53% of the revenues in 2020 but has decreased to 11% in and 2022. As Visa is expecting to continue investing in technology assets and payments system infrastructure, as well as revenue is expected to increase, CAPEX is assumed to represent 11.42%.

- Net change in working capital: Visa is managing its liquidity risk by investing excess cash in securities that enable the company to meet its working capital and liquidity needs, and earn additional income. The current assets are expected to increase by 9.4% and current liabilities to increase by 24%. Current Assets and Current Liabilities were forecasted for each year based on the historic data, and their difference representing the NWC for each year.

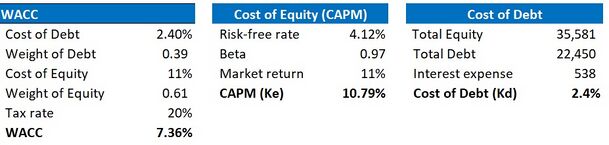

WACC

The Weighted Average Cost of Capital serves as the discount rate for calculating the terminal value based of the following assumptions:

- The risk-free rate (4.12%) was assumed to be the 5-year US treasury.

- The beta (0.97) is the 5-year monthly historical beta of Visa and shows that Visa has almost the same sensitivity as the market.

- The cost of equity (11.48%) was calculated using the capital asset pricing model (CAPM).

- The market return (11%) is taken to be the 10-year average return of the S&P 500, where Visa is listed.

- The cost of debt (2.4%) is estimated as interest expense divided by total debt, as actual cost of debt was not stated in the company’s annual report.

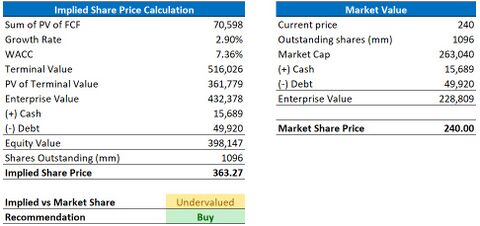

Terminal value

The terminal value was derived considering a long-term growth in perpetuity of 2.9%, which is based on the US expected GDP rate. I have assumed Visa remains a large stable market cap company with stable earnings and contributing to 2% of the overall growth in the US economy. Based on the growth rate and the WACC rate, the present value of Terminal Value for the company was determined to be $362m.

Equity value

Based on the analysis the equity value of the company is $398m. Given the total shares outstanding of 1,096 million, implied share price $363. Based on this valuation and relative to the actual share price of $240, the company is undervalued and a buy recommendation is issued.

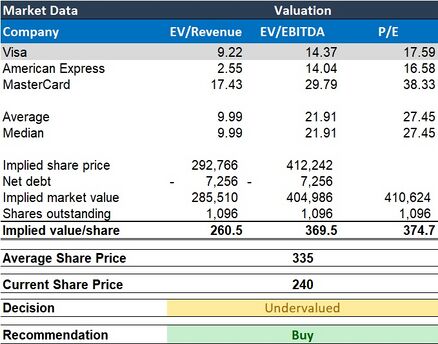

Multiple Valuation:

In addition to the DCF, a multiples valuation analysis was conducted to see if it supports my conclusions from the DCF. The closest competitors were selected in order to obtain the multiples. The multiple valuation shows that with the current price being $240, all valuations methodologies suggest that Visa Inc is undervalued compared to its competitors.

Risk edit edit source

Regulatory risk:

1.Evolving business regulations:

Visa is subject to a number of regulatory risks including the anti-corruption and anti money laundering laws and regulations such as the U.S. Foreign Corrupt Practices Act (FCPA), the UK Bribery Act, the U.S. Bank Secrecy Act and the economic and trade sanctions programs administered by the Office of Foreign Assets Control (OFAC), that prohibit the company from offering improper payments to foreign government officials and political figures and serving population that is domiciled in countries subject OFAC trade sanctions (currently, Cuba, Iran, North Korea, Syria and Crimea). Additionally, certain governments, including China, India, Indonesia, Thailand and Vietnam, have taken actions to promote domestic payments systems by imposing regulations that favour domestic providers, local ownership requirements on processors, require data localization and mandate that domestic processing be done in that country

Many jurisdictions have adopted regulations that require payment system participants to monitor, identify, filter, restrict or take other actions with regard to certain types of payment transactions on the Internet, such as gambling, digital currencies, the purchase of cigarettes or alcohol and other controversial transaction types. As well, there are an increasing number of jurisdictions around the world that regulate or influence debit and credit interchange reimbursement rates in their regions. Complying with these and other regulations increases Visa costs and reduces the company revenue opportunities.

Business Risk

1. Competition

Visa is facing an intense competition as technology evolves and new payment methods emerge. Some of the competitors include American Express, Discover, private-label card networks, virtual currency providers, technology companies that enable the exchange of digital assets, and certain alternative payments systems like Alipay and WeChat Pay. In some cases, the competitors have the support of government mandates that limit or otherwise hinder Visa's ability to compete for transactions within certain countries and regions. The company revenues and profits are dependent on the client and merchant base, which may be costly to win, retain or develop given the competitive landscape.

2. Macroeconomic conditions

Additionally, international cross-border transaction revenues represent a significant part of the company revenue and are an important part of the growth strategy. Based on the annual report more than half of the net revenues are earned outside the U.S. Revenues are dependent on the volume and number of payment transactions made by consumers, governments, and businesses whose spending patterns may be affected by economic, political, market, health and social events or conditions. Adverse macroeconomic conditions within the U.S. or internationally, including but not limited to recessions, inflation, rising interest rates, high unemployment, currency fluctuations, actual or anticipated large-scale defaults or failures, rising energy prices, or a slowdown of global trade, and reduced consumer, small business, government, and corporate spending, have a direct impact on our volumes, transactions and revenues. Covid-19 pandemic and ongoing Ukraine war as an example.

Litigation Risk:

Visa Inc can be adversely affected by the outcome of litigation or investigations. The company is involved in numerous litigation matters, investigations, and proceedings asserted by civil litigants, governments, and enforcement bodies investigating or alleging, among other things, violations of competition and antitrust law, consumer protection law, privacy law and intellectual property law. These actions are inherently uncertain, expensive and disruptive to Visa operations and the liabilities could materially harm the financial condition or cash flows, or even cause insolvency.

References edit edit source

https://stockanalysis.com/stocks/v/market-cap/

https://en.wikipedia.org/wiki/Visa_Inc.#History

https://balancingeverything.com/credit-card-market-share/

https://www.investopedia.com/visa-top-shareholders-5094563

https://www.bankrate.com/finance/credit-cards/credit-card-market-share-statistics

https://www.paymentscardsandmobile.com/unionpay-accounts-for-45-of-global-cards-spending-visa-still-on-top/

https://www.bankrate.com/finance/credit-cards/credit-card-market-share-statistics/#cards

https://www.visa.co.uk/our-purpose/leading-by-example.html

https://businessmodelanalyst.com/visa-business-model/

https://annualreport.visa.com/business-overview/

https://www.macrotrends.net/stocks/charts/V/visa/net-income

https://www.investopedia.com/how-visa-makes-money-4799098

https://usa.visa.com/dam/VCOM/global/about-visa/documents/visanet-factsheet.pdf

https://www.cbinsights.com/investor/visa

https://www.globaldata.com/company-profile/visa-inc/

https://www.barrons.com/articles/visa-mastercard-undervalued-stocks-buy-922575

https://www.macrotrends.net/stocks/charts/V/visa/net-income

https://annualreport.visa.com/financials/default.aspx

https://financhill.com/blog/investing/where-will-visa-be-in-5-years

https://www.macrotrends.net/stocks/charts/V/visa/stock-price-history

https://en.wikipedia.org/wiki/Visa_Inc.#Finance

https://craft.co/visa/competitors

https://www.finextra.com/pressarticle/65412/unionpay-takes-top-spot-from-visa-in-22-trillion-global-cards-market---rbr

https://www.valuepenguin.com/visa-vs-mastercard-is-one-better#

https://portfolioslab.com/symbol/V

- ↑

- ↑ Saini, Manya (17 November 2022). "Visa promotes McInerney to CEO as Kelly moves to board". Reuters. Archived from the original on February 4, 2023. Retrieved February 4, 2023.

- ↑